West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million

Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work WRLG has done to unlock the tremendous value in the Madsen Mine.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On May 7, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) published reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

WRLG bulk sampled 14,490 tonnes of ore @ 5.72 grams/tonne Gold, generating 2,498 ounces of gold worth CAD $11.7 million at CAD $4,700/ounce. The Madsen Mill has a permitted throughput of 800 tonnes/day.

West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025.

West Red Lake Gold Bulk Sampling Highlights:

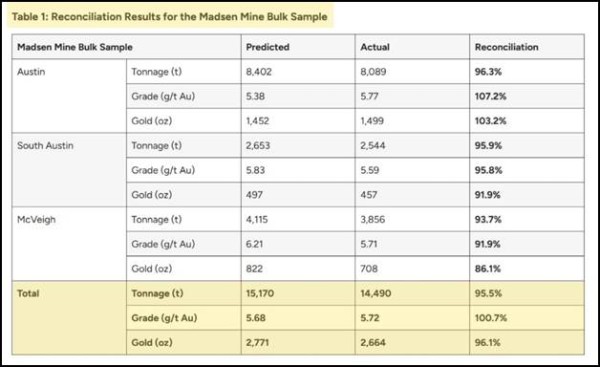

- The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

- 14,490 tonnes of bulk sample produced 2,498 ounces of gold

- Gold recovery in the Madsen Mill averaged 95%

“Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work we have done to unlock the tremendous value in the Madsen Mine,” stated Shane Williams, President and CEO, in the May 7, 2025 press release.

“This achievement underlines that Madsen is on track to become a new high-grade gold mine in 2025.”

In the May 7, 2025 video below, WRLG explains why “West Red Lake Gold is Ready to Perform and Built for Today’s Gold Bull Market.”

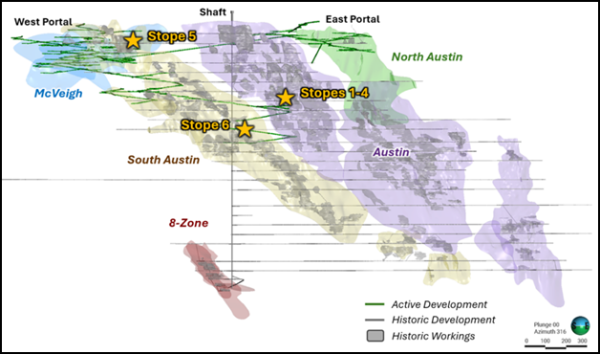

The bulk sample included material from three main resource zones at Madsen – Austin, South Austin, and McVeigh.

Close reconciliation between predicted and actual grades and tonnages highlights the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization.

West Red Lake Gold has completed over 90,000 metres of definition drilling since October 2023, and the high-confidence tonnes resulting from this ongoing program currently make up approximately 90% of the 18-month detailed mine plan.

Six stopes were drilled, engineered, and mined using the same workflow that the Company plans to implement during regular mine operations at Madsen.

“We design stopes to maximize economic benefit in today’s gold price environment. This differs from the Pre-Feasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes,” stated Williams.

“Using a gold price just below the long-term consensus gold price of US$2,350 per oz. unlocks significant opportunity at Madsen because, in many areas, a halo of lower-grade mineralization can be profitable to include in the stope design when it surrounds targeted high-grade tonnes.”

“In addition, mining larger stopes can lower mining costs by enabling long-hole stoping instead of cut-and-fill methods. We used long-hole stoping exclusively in the bulk sample.

We are excited by the opportunity to mine additional tonnes and ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan,” stated Williams in the May 7, 2025 press release.

“In a note published on Wednesday, the precious metals team [at Bank of America] led by Michael Widmer said it sees growing potential for gold to hit $4,000 an ounce in the second half of this year,” reported Kitco News.

“In March, Widmer and his team predicted that gold prices would hit $3,500 by 2027—a target the precious metal reached in less than a month.”

“In the commodities market, timing is critical. I’m betting current macro trends will boost the value of gold,” wrote WRLG Co-Founder, Major Shareholder, Strategic Advisor Frank Giustra in 2024.

Giustra was instrumental in the development and growth of several significant gold producers. Gold Corp (Wheaton River) grew from US $17 million to a $21.8 billion market capitalization in a little over five years. Endeavour Mining grew from $180 million to $8 billion in under 7 years.

“It begins with one well-executed mine acquisition, like we are proving with Madsen. It expands through smart deals and leadership,” added Giustra.

“We acquired Madsen because we believed an accurate geological model, detailed engineering design, and disciplined mining practices would enable exactly this – a mine that delivers to plan. I am extremely pleased to deliver these bulk sample results, and I look forward to ramping up operations at the Madsen Mine in the coming months,” stated Williams.

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27481

The post West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economy Jack journalist was involved in the writing and production of this article.